Please note this content is not approved for use in NY.

Issued by Minnesota Life Insurance Company

Secure and reliable lifetime income

An advantage annuities like IncomeToday! 2.0 offer over other fixed investments is the ability turn your assets into a guaranteed stream of income that cannot be outlived. It’s a valuable supplement to your Social Security benefits – helping you cover some of the routine expenses of retirement.

Unlike other investments that are subject to the risks and fluctuations of the marketplace, you can depend on annuities such as IncomeToday! 2.0 for guaranteed income that’s predictable – protecting a portion of your retirement income from market losses.

Have you planned for the possibility of living to age 90 or beyond?

If all goes well, you’ll be spending a long time in retirement. Are you prepared to live 30+ years on your retirement dollars? Consider the following:

Chances of living beyond age 65

Assumes a person is in good health in 2021. Statistics are based on the 2012 Individual Annuity Mortality Basic table projected for mortality improvements using Scale G2.

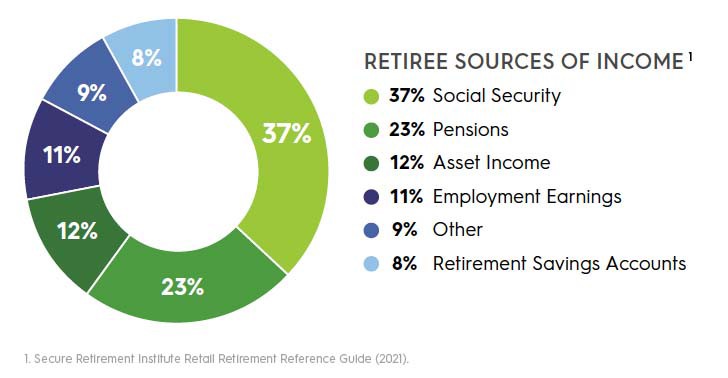

Want to see where your retirement income will come from?

Let’s take a look!Income choices and guarantees to meet your needs

You can select from a range of income options that allow you to structure an income that’s guaranteed to last for your lifetime, for a set period of time, for joint lives, or a variety of combinations that provide for beneficiaries.

Additional access with the Advance Withdrawal Benefit

See it in action on a Life with Period Certain (10 years) income option

In this example, once the guaranteed period is over, in the eleventh year annual payments jump back up for the remainder of the client’s life — to the payment level as if no withdrawal had been taken.

This is a hypothetical example for illustrative purposes only. It is not indicative of any particular investment or guarantee of future performance.

Although you’ll be receiving guaranteed payments on a frequency you choose, emergencies happen. Or, you may just find you need some additional flexibility as you adjust to your new financial needs. That’s why IncomeToday! 2.0 offers an Advance Withdrawal Benefit. The Advance Withdrawal Benefit is available for no additional cost with annuity income options that include a Period Certain guarantee.

Here’s how it works. At any time prior to the end of the guaranteed Period Certain, you can make a one-time lump sum withdrawal of between 25% to 75% of the present value of your future Period Certain annuity income payments. The minimum withdrawal is $1,000. If you make such a withdrawal, your payments for the remaining Period Certain will be reduced proportionately from the time you take the withdrawal until the guaranteed period ends. If you select a fixed Period Certain option, your income payments will stop at the end of the guaranteed period.

If you select a single or joint life option with a Period Certain, your income payment will return to the amount that would normally have been paid as if no withdrawal was made. The Advance Withdrawal Benefit provides an added measure of flexibility.

The Advance Withdrawal Benefit is an optional benefit that may be declined at time of application for purposes of preserving eligibility for certain external and/or government benefits. Please consult with an attorney to determine appropriate suitability.

Other things to know before purchasing an annuity

Keep in mind

Once you select your annuity income option – including frequency and payment dates – that decision cannot be changed. Availability of some Period Certain durations may be limited.

Satisfy your required minimum distribution (RMD)

IncomeToday! 2.0 can also be used to automatically satisfy your RMD requirements for assets rolled in from your retirement plans (401(k)s and IRAs), because it turns a portion of your assets into regular payments over your lifetime.

You must have selected one of the lifetime income options in order to use your IncomeToday! 2.0 payments to satisfy your RMD amounts. Talk to your financial professional about the income options that will help you meet RMD requirements. Keep in mind, if you select an option with a Period Certain, the time period you select can’t exceed your life expectancy.

Taxation

IncomeToday! 2.0 provides important tax advantages too. By receiving your money as an income stream, it allows you to stretch your tax liability over time.

For nonqualified annuities, a portion of each income payment you receive is classified as a return of your initial purchase payment (your cost basis). That part isn’t taxed. Only the interest portion of each payment is taxable. Your cost basis is then eventually returned to you over an extended period of time. After that, your entire income payment becomes taxable.

If you purchase your annuity with qualified money, such as assets from your 401(k) plan or IRA, then your income payments are fully taxable in the year you receive them, since no taxes have been paid on that money.

Next steps

Are you ready to take the next steps toward guaranteed retirement income?

Review the product and consumer resources — you can print any you’d like for your records. Your financial professional will take care of working with our support team to obtain the paperwork you’ll need to complete.

Why an annuity?

Make the most of your retirement years

How do you anticipate spending your retirement? Exploring new passions, spending more time with family and friends, volunteering, traveling?

You’ve worked hard for your next chapter — and maybe you’re still working to make it a reality. But do you have a strategy for navigating common risks that could greatly affect your retirement?

If you're having trouble picturing how you want to spend retirement, take our retirement personality quiz to get a rough idea of where you could be leaning.

Common retirement risks

Work with your financial professional

Your financial professional can help you identify whether an annuity is a good fit for you. Together, you can review the specific features of one you may be considering and develop a retirement strategy to account for any risks to the future retirement income you’ll depend on.

Why Securian Financial?

At Securian Financial, we’re here for family. And we’re here because of it. And we believe your financial picture should support the everyday moments as much as the major milestones.

Since 1880, we’ve been committed to providing insurance, investment and retirement solutions that give families the confidence to focus on what’s truly valuable: banking memories with those who matter most.

Learn more about us – including how our purpose, values and financial strength help customers like you build secure tomorrows.

Learn more about Securian FinancialIncomeToday! 2.0 is a single payment immediate annuity. The guarantees in IncomeToday! 2.0 are subject to the financial strength and claims-paying ability of the issuing insurance company. You should thoroughly review your contract for specific details of the product features and costs.

Income payments and withdrawals from immediate annuities are generally taxable as ordinary income in the year in which taken. When purchased as part of an IRA or other qualified plan, the IRA or qualified plan already provides tax deferral of earnings and the annuity contract does not provide any additional tax deferred treatment of earnings. Withdrawals taken from a qualified plan prior to age 59½ may incur a 10% federal tax penalty. This information should not be considered tax advice. Please consult a tax advisor for specific information.

Keep in mind that the Annuity Income Option, Frequency and Payment Dates cannot be changed once elected. Availability of some Period Certain durations may be limited. Clients should thoroughly review their contract for specific details of the product features and costs.

This information should not be considered as tax or legal advice. Clients should consult their tax or legal advisor regarding their own tax or legal situation.

This is a general communication for informational and educational purposes. The information is not designed, or intended, to be applicable to any person’s individual circumstances. It should not be considered investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action. If you are seeking investment advice or recommendations, please contact your financial professional.

A purpose of the method of marketing is solicitation of insurance and that contact will be made by an insurance agent or agency.

Insurance products are issued by Minnesota Life Insurance Company in all states except New York. In New York, products are issued by Securian Life Insurance Company, a New York authorized insurer. Minnesota Life is not an authorized New York insurer and does not do insurance business in New York. Both companies are headquartered in St. Paul, MN. Product availability and features may vary by state. Each insurer is solely responsible for the financial obligations under the policies or contracts it issues.

Policy form numbers: 21-70645, ICC21-70645, 21-70647, ICC21-70647, 21-70648, ICC21-70648.

Securian Financial is the marketing name for Securian Financial Group, Inc., and its subsidiaries. Minnesota Life Insurance Company and Securian Life Insurance Company are subsidiaries of Securian Financial Group, Inc.

DOFU 1-2022

1967864